February 10th, 2022 –

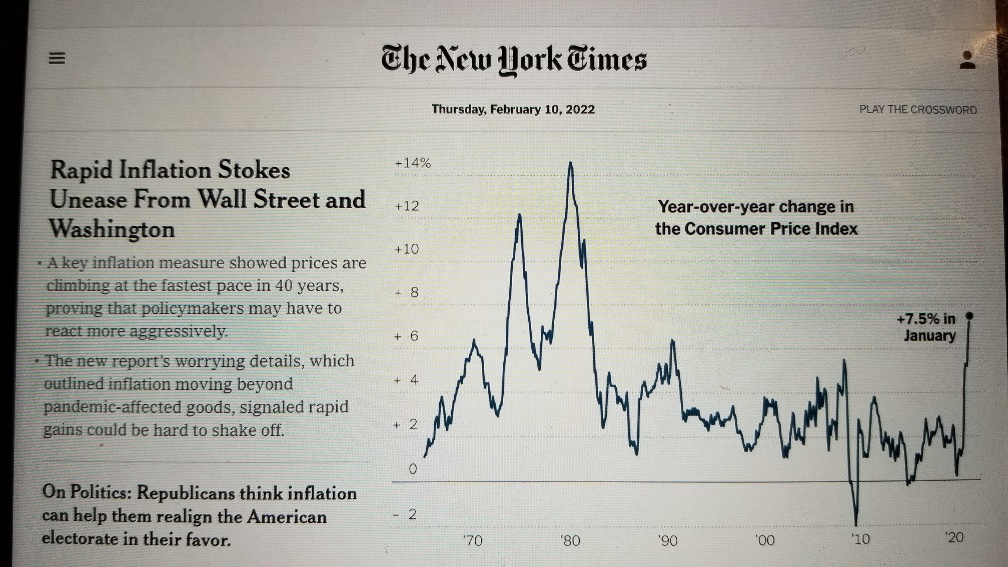

Today it was announced that inflation for last month, January, surged 7.5%. The experts, the pundits, the stock market mavens had forecast anywhere from 5% to 7.2%. Surprise, surprise – inflation turned out to be like that ornery child who refuses to behave. It was supposed to go down slightly, but it actually sped up.

Until recently, the Fed had proclaimed inflation “transitory”. Chairman of the Fed, Jerome Powell, retired the word “transitory” at the end of November when it became apparent that inflation was increasing rather than decreasing. Apparently, the Chairman was surprised that inflation was actually accelerating. Who knew?

There are many reasons for inflation:

Cost of materials went up worldwide, increasing the cost of producing products worldwide. Cost of shipping products went up worldwide. The Pandemic caused unemployment and shutdowns that slowed production of many products worldwide, adding to the costs of producing products.

With advent of the Pandemic, the U.S. Government launched large relief packages to assist people and companies, literally printing and dispersing billions of dollars. The increase in the printing of money increased the yearly deficits of the United States, but it also devalued the currency because the added spending was not offset by added income to the government.

And because inflation increased rapidly in the United States, many workers requested and held out for wage increases. And because businesses had difficulties hiring and getting people, they were forced to increase the wages they paid. At the same time, the people accepting new jobs at higher wages quickly found the price increases of everyday products they bought was accelerating faster than their salaries.

All of these factors had an influence on the prices of products and services in the United States. It was thought by the best and brightest in the economic community that these increases were short-term or in the words of Chairman Powell, “transitory”. But as mentioned, right up to this week, inflation had the nasty habit of increasing rather than decreasing.

The best and brightest of the economic community still believe that increases are only “transitory” and almost all forecasts are for inflation to sharply decrease by year end.

BCE, aka Buffalo Chip Express, would like to suggest that the predictions of a sharp decrease of inflation by year end may not happen.

BCE would like to suggest that the higher cost of goods and services and materials and wages may only be beginning.

BCE would like to mention that when goods are produced in other countries, the manufacturers of those goods pass on higher costs only as they occur. And in truth, exporters only began to pass on higher prices about 6 months ago. However, the companies importing and selling those goods in the United States did not raise prices immediately because they had stock of goods already bought at lower prices. Most companies try to raise prices only once a year. So, most companies only began their price increases of imported goods in January of this year.

BCE would like to also mention that just because an importer has announced price increases, that does not mean the price of the goods go up immediately in stores. That is because stores also have inventory and they tend to raise their prices only as they receive new goods that they have to pay more for. So, the process of passing on price increase takes time and BCE would suggest that many price increases announced by exporters 6 months ago will only show up in retail outlets at the consumer in the next 3 months.

Of course, not all goods sold in the United States are imported. We still do manufacture a lot of goods, but in manufacturing, a lot of inflationary factors are also at play. The fact that we are still in Pandemic has greatly added to the costs of manufacturers, because they have experienced added costs for the times they have had to shut down, for the times they had people out sick, for the increases in wages that they have to pay, for the increases in shipping costs both shipping parts and materials to them and shipping finished goods to their customers. And, of course, they have had to pay increased prices of materials and parts that they need for the production.

So U.S. manufacturers have seen many costs rise and are still seeing costs rise. And manufacturers, like importers, generally only pass on price increases when price increases are passed on to them. But make no mistake: they must pass on price increases if they are to be profitable and remain in business.

BCE would like to note another factor looming over the U.S. economy and that is the price of oil. On the same day that the government announced 7.5% inflation, the price of oil hit $90 several times that day. The price of oil has in the last 18 months increased from a low of $40 to the present high of $90+.

Those of you familiar with what is known as the “driving season” might remember that the price of oil has a mysterious tendency to increase in the spring and summer when most people drive a lot. This coincidence seems to occur fairly consistently over the last 50 years. And, of course, if it was to occur this year, it would probably mean that the price of oil is about to head up the mountain on a journey from $90+ to $130+ or more.

Of course, history and coincidences don’t always occur, but they do, as Mark Twain noted, tend to rhyme. So, BCE guesses that we will see a further sharp rise in the price of oil this spring and summer. As most you know, that probably means that the price of gas, presently anywhere from $2.50 a gallon to $4.50 a gallon, might be $5 to $7 this summer.

Economists speak of oil shocks, but this truly would be a “gas shock”. No change like the above comes about without creating other changes. As people notice the price of gas going up weekly they will realize that inflation is taking more and more of their salary and as that happens there will be an increase in the demand for higher wages. So, the likelihood is that manufacturers and stores and hospitals and hotels and convention centers and water parks and airlines and banks and all other businesses will find themselves with employees wanting more wages.

BCE would like to point out that the difficulties from an oil shock and a gas shock do not stop there. Plastics are a derivative of oil and so all parts and any products made using plastic are likely to go up sharply this spring and summer. And of course, all of these price increases will only start feeding into our economy this spring and summer. And because the lag time between material price increases and product price increases is long, the real impact may only be felt in the fall of this year and in the first 6 months of 2023.

To summarize, BCE thinks the thought that prices will moderate sharply in the coming months is Buffalo Chips.