Pundits, economists, Financial Broadcasters, CNBC, Bloomberg, Fox Business News and various finance publications all agree – markets are the true barometer of the health of our economy and the font of all wisdom. For this reason, it is instructive to review the recent path of various market moves to see what truths they reveal.

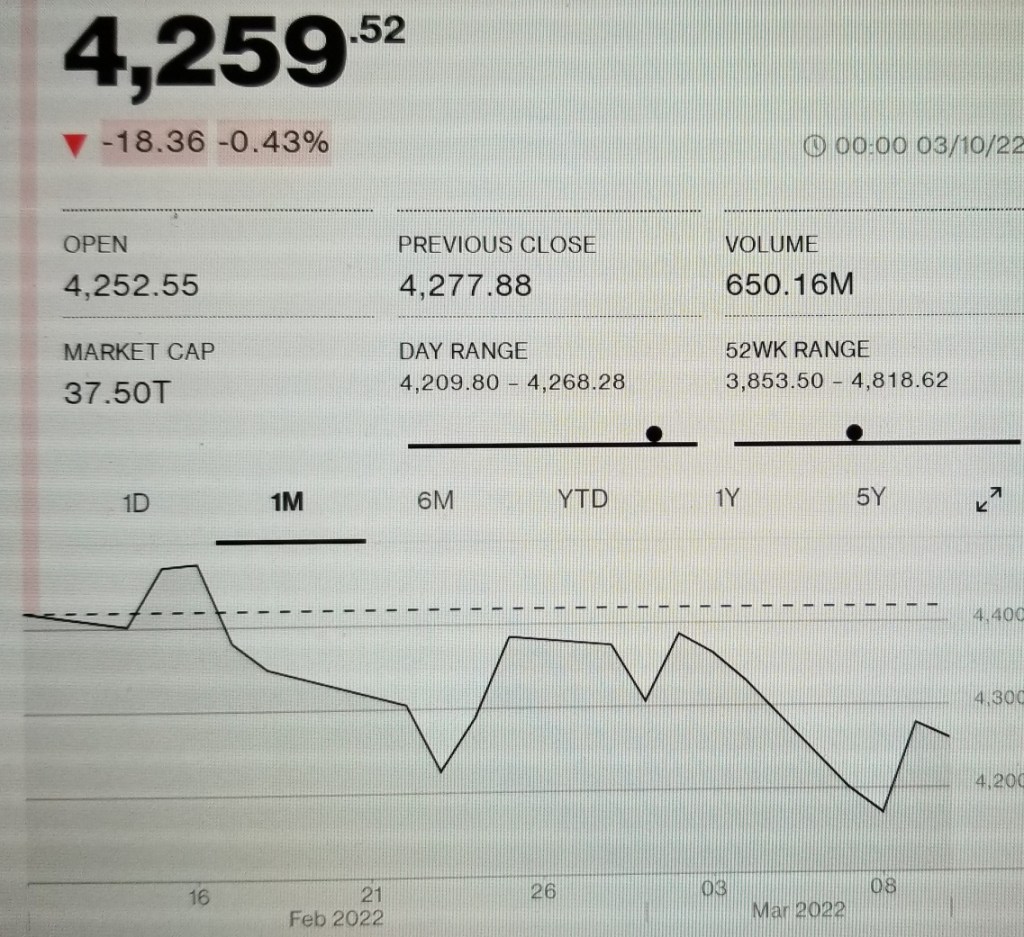

For 5 days leading up to the invasion of Ukraine, markets trembled with stocks declining everyday. Thereafter, the market both soared and repeatedly sank. By the first week in March, the markets were generally down and as the days passed, the markets went down more. There was a miracle upturn in the beginning of the second week of March, but the course of the market was still described by some market observers as “choppy”.

The invasion of Ukraine proved to be far more extensive then originally thought. Czar Putin moved his forces into Ukraine from four different directions, but so far they have they have not moved much from their original entry points. To the surprise of many, the Ukrainians defended themselves in heroic and surprising ways and after almost two weeks, while the Russians had made advances in the South of Ukraine, they still had not captured any large Ukrainian city.

The markets adjusted dramatically to the ups and downs of the war by dramatically going up and down on various days with the hopes of a quick solution early in the invasion fading and the reality of a drawn out invasion rising as the first 15 days passed. The reasoning of markets was that an invasion of Ukraine might be bad for the markets and, maybe even, for the economic health of the world economy. No doubt it would raise the price of gas and this would further raise prices in the U.S. Who knows, the FED may have to raise interest faster or slower.

To the surprise of many, Ukraine has withstood the initial attacks of the Russians and has inflicted casualties on Russians and damage to Russian tanks, planes and helicopters. This slowed the Russian invasion and troop movements became bogged down in several parts of the country. It would seem the Ukrainians were better prepared and better armed than originally thought. At the same time, the U.S., the UK. and the EU instituted some sanctions. And as the days passed they issued more sanctions almost every day.

While NATO and U.S. were unwilling to either establish a “no fly zone” or commit troops in the Ukraine, they eagerly sent in weapons and missiles and rocket launchers from surrounding countries. So, not only did the Ukrainians fight far more ferociously than the Russians had planned, it turned out that the Ukrainians were able to get access to lots of weapons.

And while the Russians and Ukrainians were warring and the U.S., EU and UK were sanctioning, the price of oil rose to over $100.

On the second day of the invasion, word came that Czar Vlad might entertain talks with the Ukrainians. Of course, there were a couple minor conditions: The Ukrainian military would have to surrender. Ukraine would have to become “de-militarized and de-nazified”. The price of oil fell a bit and the markets soared on this news.

Peace talks took place and nothing happened and the markets took a breather and considered the situation. And then the Russian invasion resumed. To the surprise of even more analysts, the Russian attacks were met with continued fierce resistance from the Ukrainians. In the meantime, the U.S., the UK and the EU instituted more sanctions and sent in more weapons.

The Russians shifted military techniques doubling down on bombing and shelling and indiscriminate murder of civilians and destruction of buildings, schools, hospitals, towns and cities. The markets continued on their jagged course, up a day or two and then down for several days in a row. And as the chart above indicates, the general direction drift of markets were down, while the general direction of the price of oil was up.

Within the markets, the pundits deliberated the daily happenings and considered the most important issues of each day…do we buy on the dips, will the S&P break 5,000 by year end, will their be a cost increase in Billionaire homes in The Hamptons this summer, will the war extend to NATO, could World War III affect stock option trades?

So many questions from the purveyors of wisdom.