There are a lot of economists, pundits, bankers, financial advisors and Wall Street types predicting peak inflation. That is the theory that inflation has already peaked and will decline in the second half of this year. That theory was thrown into a tizzy this last Friday on June 10th when it was announced that inflation had actually accelerated instead of declined. Who knew?

Well, probably, a lot of people knew. One has only to tabulate a few of the contributing factors to figure out that inflation was very likely to accelerate both now and in the coming year. Let us counts the reasons:

- The cost of many goods have gone up because of tariffs and increased material and manufacturing costs in the U.S., Asia and in many other countries.

- Shipping delays, shortages of goods in stores and costs to ship goods by air, sea, train or truck have all gone up and all caused goods that have to be transported to become more expensive.

- Labor costs in Asia, Europe and the U.S. have gone up because many people were unwilling to continue working at the same salary. The simple reason for that was that their living costs were going up daily and they needed more money to pay for those increased costs.

- People are flying and driving more and using more gas because more people are employed and more people have to drive to work and more people want their revenge vacations now.

- Our ever wise President sought to save planet from fossil fuels at a time he did not realize we would need more fossil fuels.

- The war in Ukraine and sanctions the U.S., UK, EU, and NATO imposed on Russia have slowly deleted access to 30% of the world natural gas and oil supplies from the West.

- Ukraine, the well-known bread basket of Europe and many parts of the world has been deleted at least temporarily as a supplier various grains the world needs.

- Big spending programs intended to pull the American people and American businesses out of the recession have succeeded, but in doing so, the large amount money printed by Government has caused inherent and systemic inflation.

- The threat of further shutdowns, further shortages and a wider war in Europe are all causing oil and gas prices to spike to new highs daily. This may be speculation, but it results in higher gas and oil prices.

- And oh yeah, there is something called The Pandemic which keeps changing, mutating and spitting out new variants that keep getting more people infected with Covid in spite of some people being Vaxxed to the Max.

Given all of the above, one may wonder why it is that so many financial experts have been bravely been predicting inflation was about to decline and that it would surely decline in the second half of this year.

Buffalo Chips Express, being a skeptical form of media, thinks the answer is simple. There are many people who want to keep the party going and sell more stocks, more goods, more bonds, more Crypto Currencies. Indeed, all of us, would like the economy to get better. The only problem is, the reasons that inflation is going up are still only increasing. Sorry folks, the ride ahead is bumpy.

Some of the same pundits and experts in financial matters have explained the reason why they think that inflation will decline. They say that many companies bought too many goods during the time of shipping and manufacturing delays. Therefore, these experts confidently predict that the prices will go down for those over bought goods for the very logical reason the companies will want to sell down the overbought goods.

And while BCE (aka Buffalo Chips Express) would agree that the prices of some goods will go down somewhat in order to reduce some overbought inventories, but that is not likely to last long or reduce inflation in any significant manner. BCE would remind you that companies may reduce price of some goods to get rid of some inventories, but after that, companies have to sell things in future at a profit.

BCE would like to ask you a simple question:

Would you sell off goods that you sell year after at a loss if you knew those same goods would cost more when you next have to buy them?

BCE thinks retailers will sell down some goods at sharply lower prices if they literally clog their warehouses, as they do for some companies. BCE also thinks retailers will slash prices of goods they plan to discontinue. But unless the reasons cited above for persistent inflation literally evaporate or manufacturers kindly sell their goods to retailers at loss, the costs for new replacement goods will go up and those costs will be passed on to consumers.

Yes, the rate of goods sold will probably decline. Yes, many people will change their buying habits and simply not buy some things, but in either case, the ongoing costs for replacement goods will go up. And yes, the demand for all goods is likely to go down at some point.

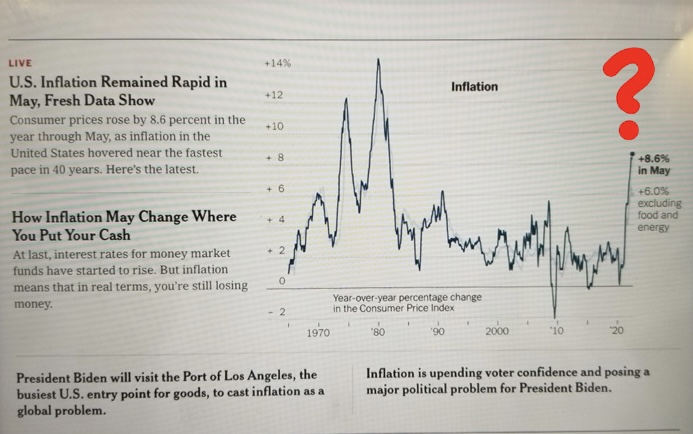

All of this leads to question of when prices will go down. Here BCE suggests a look at history may be helpful. From the 1970s to the 1980s inflation and interest rates went up year after year in this country.

In case you are thinking the world then was very different place, you are right. It was. There was an Arab Oil Embargo and The Mideast War that quadrupled the price of oil. And there was the the War in Vietnam where we sent hundreds of thousands of American soldiers and arms of every kind. Russia was a communist domain, aka The Soviet Union, under the power of one man and a Politburo and, at that time, Ukraine was part of the Soviet Union. China was a large and emerging third world country under the leadership of Mao Zedong and later Deng Xiaoping, impoverished still by a brutal Civil War, famine, and a cultural revolution. And, yes, inflation was raging across the world.

In the 1970s and 1980s, prices and interest rates went up astronomically for over 10 years. We can hope that some solutions will be found to the War in Ukraine, that Arab countries will sell the West more oil, that container prices will come down, that material and parts costs go down, that most things that America buys will be made in the U.S., but at the moment we are very far from that.

So BCE suggests you plan high inflation for some time to come.