There has been a lot of debate about inflation. A lot of pundits, politicians and economists have chimed in on the subject. Recently, many economic experts have claimed that inflation is coming down.

Well, yes and no. The Rate of Inflation is coming down and some isolated prices have come down, but most prices are still going up.

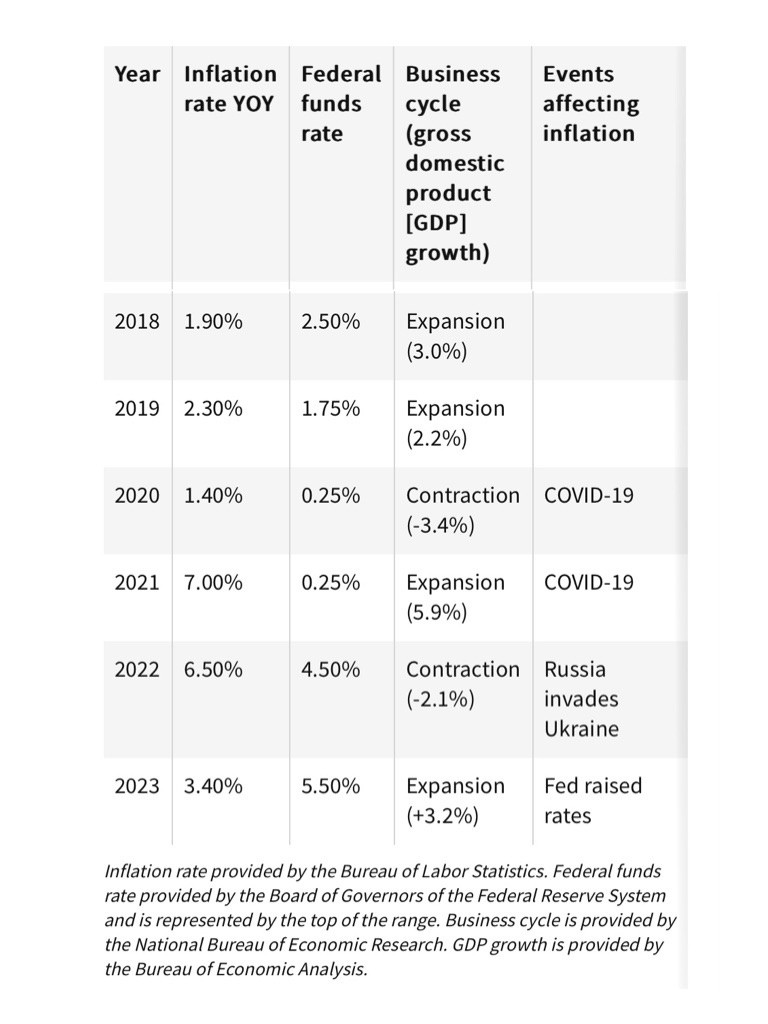

Below is a chart of inflation for each year from 2018 to 2024 along with some information about interest rates, gross domestic product in each year and mention of two events that have influenced those numbers. As you will see from the chart, inflation was very quiet up until the year 2021. Then, it jumped up sharply in 2021 and 2022 and then went down in 2023. So far, inflation in 2024 was 3.1% in January, 3,2% in February and 3.5% in March – so inflation is running about 3.25% so far this year.

The numbers above do not seem to explain why prices are so much higher in 2024 than 2019 or why when inflation is coming down, prices are going up.

NEWS FLASH #1: Inflation is Cumulative!

Let us explain: if a group of products cost $100 in 2018 and then we apply the rate of each year from 2019 to 2024 is to the $100, here is what happens:

2019 – $100 x 1.023 = $102.30

2020 – $102.30 x 1.014 = $103.73

2021 – $103.73 x 1.07 = $110.99

2022 – $110.99 x 1.06.5 = $118.21

2023 – $118.21 x 1.034 = $122.23

2024 – $122.23 x 1.0325 = $126.20

So, by this math, what costs $100 in 2018, now costs $126.20 in 2024. Of course, that is only for an average of $100 of supposedly typical products. As you can see from the picture of a chart at the top of this blog story, many different other products are up much, much more.

Who knew?

NEWS FLASH #2: Inflation Tends to Feed On Itself!

What is not often mentioned by economists and politicians who may be hopeful of different results, once inflation begins it historically tends to feed on itself. That is because of some very logical reasons.

Here is what usually happened in the past: as inflation goes up, people earning limited salaries demand higher salaries. Why? Because their salaries do not go as far they did. This generally leads to companies reluctantly giving higher salaries so employees can keep up with price increases. That generally leads to companies then raising prices for the products they make to compensate for the increased salaries they are paying.

WHO KNEW?

NEWS FLASH #3: Other Factors Affect Inflation!

Inflation is actually quite a complicated subject and while it is cumulative and it feeds on itself, other factors do affect inflation. As mentioned in the chart above the Federal Funds Rate has gone up sharply in 2022 and 2023. Now economics pundits, stock market mavens, politicians are all confidently predicting that the Federal Funds Rate will go down but the current trend has only been up.

Why is that important. The Federal Fund Rate determines and influences interest rates for banks, credit cards, mortgages, business loans, and the Government. For example, the U.S. Government is estimated to pay about $870,000,000,000 interest for the fiscal year 2024. In case those zeros look a little confusing, that is 870 billion dollars in interest only. Oops.

Or put another way, that is 870 billions dollars more the Government has to borrow before it borrows money to pay for the yearly actual costs of government, such as Social Security, Military expenditures for weapons, government salaries, etc.

And of course, when the Fed Funds Rate goes up, it also means that credit card rates and business expenditures for interest also go up. That tends to also increase inflation because it increases costs for everybody.

NEW FLASH #4: Outside Events Also Increase Inflation & Prices

As is noted in the chart showing the rate inflation from 2018 to 2023, outside events also affect inflation. In 2020 and 2021 Covid caused major shutdowns of businesses and a sharp rise in unemployment. The government responded by issuing massive amounts of money to individuals and businesses to help them get through the period of shutdowns. That stimulated the economy and caused large supply chain problems which in turn led to large price increases on different products.

And as noted in the chart above, in 2022 Russia invaded Ukraine. That also stimulated the demand for munitions and military gear to be sent to Ukraine and caused a sharp rise in the price of oil. Finally, as not noted in the chart above, on October 7th, Hamas attacked Israel and shortly thereafter Israel attacked Gaza. That war and the further tensions that arose from that war tended to further increase the price of oil and gasoline.

It should be noted that other regional events are affecting prices and inflation. The collision of a giant container ship into a not so giant support structure for the Key Bridge led to the collapse 1.6 miles of that bridge and i695 to cease. That closed the port of Baltimore, threw thousands of people temporarily out of a job and trapped or delayed a number of container ships either waiting to get in or out of the port. And naturally, that will be increasing the prices of certain product and transport costs in general.

The list of different events that have potential economic effects is large. It includes hurricanes, wildfires, floods, droughts, stock market crashes, wars and other outside events. Many of these potential events are unpredictable and unknowable as to when they might occur and how they might affect inflation and the price of goods.

One thing is for sure…all of those things can affect inflation and the prices people pay for the things they buy.

Who Knew?